A new Environmental Working Group analysis identifies and posts online more than 1.2 million prospective recipients of a proposed $1.5 billion crop subsidy bonus contained in HR 4939, The Emergency Supplemental Appropriations Act for Defense, the Global War on Terror, and Hurricane Recovery of 2006. The Senate is expected to act on the spending bill this week.

The analysis finds that the subsidy bonus, while well-intentioned as a means of helping farmers with high energy costs in 2005, is both unfair and wasteful, particularly since taxpayers provided a record $23 billion in farm subsidies in 2005, and U.S. net farm income last year was the second highest in history.

Like virtually all subsidies, the $1.5 billion bonus goes exclusively to a minority of farmers who grow a few subsidized crops - corn, wheat, rice and cotton and soybeans will account for most of the spending. Meanwhile, the two-thirds of the nation's farms that produce unsubsidized crops such as fruits and vegetables will receive none of the $1.5 billion bonus. California, the number one agricultural state in terms of production value, ranks 12th in bonus subsidy payments for "energy assistance", and Florida, the number two state in the nation in fruit and vegetable production, ranks 36th in bonus cash.

For the farmers lucky enough to get bonus money, the distribution of funds is strikingly unfair. The top 1 percent of bonus recipients will average $21,000, the average bonus for the bottom 80 percent of recipients will be $369, about 57 times less. Forty-seven (47) large farms will collect more than 100,000 (excluding one State agency, the Bureau of Indian Affairs, and five Indian Tribes), while more than 300,000 recipients will receive less than $100.

The bonus money is in addition to $5.2 billion these same farmers received in automatic subsidy payments in 2005. While cloaked as energy assistance, bonus recipients are not required to demonstrate any need, nor has the congress or USDA provided any evidence that the farmers receiving the money are those hardest hit by recent increases in energy prices.

EWG's analysis found:

- A total of 1,120,525 recipients will be eligible for the subsidy bonus, which will cost $1.56 billion.

- Just ten percent of the subsidy bonus recipients will collect nearly 60 percent of the money.

- The top 1 percent of subsidy bonus recipients will collect 15 percent of the payments, totaling $238 million, or over $21,000 each on average. Some 54 large crop operations will receive more than $100,000, and 476 recipients will collect over $50,000.

- The bottom 80 percent of recipients (896,420 of them) will receive a total of $331 million, or about $369 each on average.

- USDA records indicate that at least 10 percent of the subsidy bonus will go to recipients who own land but do not farm it themselves. These landowners, including absentee owners, have not incurred increased energy costs-the farm operators who rent their land have.

- The top five states for the subsidy bonus are Iowa, Illinois, Texas, Nebraska and Kansas, which together will receive 40 percent of the money. California, the number one state one farm state in terms of production value, will rank 12th in subsidy bonus payments, and Florida, ranked ninth for value of farm production, will rank 36th in subsidy bonus payments.

- Corn producers will account for the biggest share of bonus subsidies, with $626 million (795,673 recipients). Wheat will follow, with $338 million (673,463 recipients), and upland cotton will account for $181 million (123,690 recipients).

Top 10 recipients of the Bonus Subsidy

| Rank | Recipient* | Location | Fixed Direct Subsidy, PY 2005 |

Estimated Bonus Subsidy, 2006 |

| 1 | Balmoral Farming Partnership | Newellton, LA 71357 | $670,276 | $201,083 |

| 2 | Benwood Farms | Earle, AR 72331 | $660,643 | $198,193 |

| 3 | Dublin Farms | Corcoran, CA 93212 | $643,948 | $193,184 |

| 4 | Century Farms | Pingree, ID 83262 | $583,265 | $174,980 |

| 5 | Live Oaks Planting Company | Schlater, MS 38952 | $538,157 | $161,447 |

| 6 | Due West | Glendora, MS 38928 | $526,713 | $158,014 |

| 7 | Phillips Farms | Holly Bluff, MS 39088 | $495,487 | $148,646 |

| 8 | Condrey Farms | Lake Providence, LA 71254 | $477,772 | $143,332 |

| 9 | The Hendersons Liberty Farms | Devers, TX 77538 | $476,792 | $143,038 |

| 10 | Morgan Farms | Cleveland, MS 38732 | $447,848 | $134,354 |

Background

In March, 2006, the Senate Appropriations Committee added a number of controversial1 spending items to the Emergency Supplemental Appropriations Act for Defense, the Global War on Terror and Hurricane Recovery 2006.

One major amendment is a disaster aid package for agriculture that is estimated to cost $3.9 billion. According to the Congressional Research Service (CRS), this disaster aid will be additional to the $1 billion in emergency agricultural assistance already provided for 2005 in a previous emergency supplemental (Public Law 109-148)2, and "includes an estimated $1.5 billion in various types of crop disaster payments, $619 million in livestock assistance, and $1.5 billion in 'economic loss' payments to certain growers of government-supported crops who have been adversely affected by high energy costs." CRS notes that the amendment also provides an estimated $35 million in emergency funds for USDA's Tree Assistance Program to reimburse costs of replanting trees, bushes and vines, and $17 million in emergency conservation assistance and $109 million for emergency watershed protection. "For fruit, vegetable, livestock and dairy producers," CRS states, "the Senate bill provides a combined total of $100 million to the states, with the condition that the funds be used in some manner to support these commodities."3

Without question, agricultural disaster assistance is appropriate for many parts of the country that experienced weather-related crop, livestock or tree losses in 2005 or, as in the case of North Dakota, where bad weather seriously disrupted planting of winter wheat in 2005 that will be harvested this year. It is also true that energy costs increases for all of agriculture in 2005.

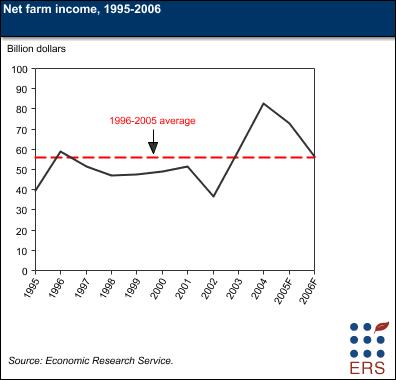

Nevertheless, the disaster assistance proposed by the Senate appropriations committee comes as U.S. agriculture posted its second highest net farm income in history in 2005 and taxpayers provided a record $23 billion in subsidies.

Footnotes

1See for example: Riedl, Brian M. and Alison Acosta Frazer. April 17, 2006. "The Senate's Deadly Sin: Larding Up Emergency Appropriations." The Heritage Foundation. WebMemo #1038. (http://www.heritage.org/Research/Budget/wm1038.cfm). Also see: Wolf, Richard. April 24, 2006. "Emergency spending bill spotlights GOP division." USA Today.

2Department of Defense, Emergency Supplemental Appropriations To Address Hurricanes in the Gulf of Mexico, and Pandemic Influenza Act, 2006. Signed into law Dec. 30, 2005. (

3Chite, Ralph M. April 10, 2006. "Agricultural Disaster Assistance." CRS Report for Congress.

2005 Income and Subsidies

2005: Second Highest Net Farm Income In History. The pending $1.5 billion bonus subsidy in the Senate's emergency supplemental appropriation comes as U.S. agriculture posts the second-best net farm income in history — income after all farming expenses, including fertilizer and energy — and as taxpayers have been saddled with record levels of farm subsidy payments.

According to USDA, in 2005 net farm income is forecast to be $72.8 billion, following the $82.5 billion record set the previous year (see chart). USDA projects a further decline for 2006 to $56.2 billion, but even this level is still above the 10-year average.

As USDA explains, "The 2-year period 2004-2005 was one of unprecedented income creation for the U.S. farm sector, when both crop and livestock commodities experienced exceptionally favorable market and/or production conditions."4 Cash receipts were surprisingly strong for crops at $114.1 billion, the second-highest year on record, in part because weather-related damages to crop yields were much lower than anticipated. In Illinois, for instance, mid-season concerns that drought would result in a dramatic drop in corn yields were belied by an unexpectedly large harvest. Moreover, USDA notes that "the income earned by farm operator households in 2005 is expected to continue a 5-year string of increases." According to the most recent USDA estimate, farm operator household income will average $83,461 in 2005. The most recent estimate available for all households shows average income much lower, just over $61,000 (for 2004).

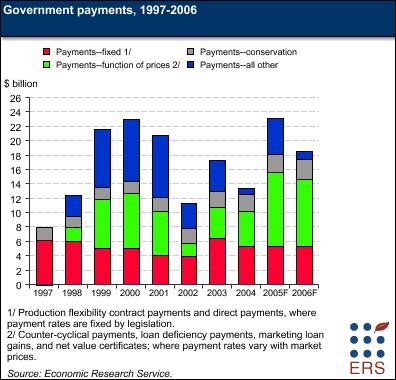

2005: Record Farm Subsidies. Farm subsidies in 2005 will set a record of $23 billion, just above the previous mark of $22.9 billion in 2000 (see chart below).

Footnotes

4Covey, et al., op cit.

Energy: Agriculture is Resilient

Like the rest of the economy, farmers were hit with energy cost increases in 2005. However, total production expenses increased only 5.6 percent. As USDA noted, "while the effects of rising energy costs are significant, the [agricultural] expenses they affect most still account for only about one-sixth of the farm sector's total costs of production."5

As a proportion of total production expenditures, some crops — such as wheat and feed grains — are more sensitive to energy price rises than others. Also, some regions have higher farm energy costs than others. However, according to the 2002 Census of Agriculture, over 95 percent of farms — more than 2 million of them — reported expenditures for gasolines, fuels, and oils: a broad category of production expenses tabulated in the Census.6 In California in 2002, 96 percent of farmers reported such expenditures, which amounted to $8,000 per farm on average. In Florida, 97 percent of farms reported gasoline, fuel and oil spending, which averaged about $3,400 per farm. In North Dakota, 84 percent of farms reported fuel expenditures at about $6,200 per farm. Clearly energy price increases since 2002 have affected a wide range of American farmers and ranchers, not just those who produce subsidized crops and who are therefore eligible for the bonus subsidy provided in the Senate's emergency supplemental appropriation.

As will be noted below, the bonus subsidy, like the fixed direct payments on which they are calculated, will be directly proportional to a recipient's eligible production — the greater the production, the higher the bonus subsidy. But USDA has found that larger "commercial" farms, which produce most of the farm commodities and consume most of the purchased inputs, utilize several business practices that lower their energy costs. "Nearly 49 percent of commercial farms locked in input prices and 41 percent negotiated price discounts for their purchases. Their businesses are also sufficiently large so that they can employ other management practices that can help reduce the prices they pay for inputs and help mitigate market uncertainties."7

Notwithstanding short-term impacts of increased energy prices on farmers' and ranchers' bottom lines, the USDA's Economic Research Service notes that agriculture has proven resilient to high energy costs: "Energy intensity [total farm output per unit of energy use] in U.S. agriculture has declined over time due to energy efficiency gains and changes in commodities produced" between 1948 and 2002.8

Some proponents of the bonus subsidy provision in the Senate emergency supplemental appropriations bill argue that those particular farmers deserve additional funds because they are unable to pass increased energy prices on to the buyers of their crops. That is true of virtually all farmers and ranchers, however, including those who will be excluded from eligibility for the commodity bonus. For that matter, most wage and salary workers, as well as the households they support, are also unable to "pass along" their higher energy costs. This inability to transfer costs includes millions of Americans earning the minimum wage, or just above or below it.

Household energy costs can also be higher depending on regional location and public transportation options. An EWG analysis of Department of Energy data indicates that the average household in 10 major metropolitan areas paid $402 more for fuel in 2005 than it paid in 2004, but for some metropolitan areas lacking well-developed mass transit, the household cost increase was even greater: Miami (+ $442), Houston (+ $539) and Denver (+$584). All of these increases in household expenditures for gasoline are greater than the $369 that will be paid, on average, to 80 percent of the prospective recipients of the Senate's crop bonus subsidy.

| Metropolitan Area | Avg. Price of Gas '04 | Avg. Price of Gas '05 | Extra Yearly Cost Per Driver | Extra Yearly Cost Per Household |

|---|---|---|---|---|

| Boston | $1.86 | $2.26 | $200 | $355 |

| Chicago | $1.90 | $2.32 | $225 | $391 |

| Cleveland | $1.80 | $2.22 | $218 | $385 |

| Denver | $1.80 | $2.24 | $309 | $584 |

| Houston | $1.71 | $2.17 | $273 | $539 |

| Los Angeles | $2.15 | $2.49 | $193 | $349 |

| Miami | $1.91 | $2.39 | $220 | $442 |

| New York | $1.90 | $2.30 | $167 | $252 |

| San Francisco | $2.15 | $2.48 | $193 | $330 |

| Seattle | $1.95 | $2.36 | $213 | $400 |

| Average | $1.91 | $2.32 | $221.10 | $402.70 |

Source: Compiled by Environmental Working Group from US Departments of Energy and Transportation data.

Ironically, even higher costs will be paid by rural households with drivers that, on average, drive almost 4,000 more miles per year than their metro area counterparts, and are more likely to drive SUVs or trucks that get poorer mileage. But the bonus subsidy is not targeted to rural households, only a minority of which have agriculture as their primary source of income. Even fewer rural households will benefit from the bonus subsidy that ostensibly aims to ease fuel costs for a narrow group of subsidized crop farms.

Footnotes

5Covey, Ted, Robert Green, Carol Jones, Jim Johnson, Mitch Morehart, Robert Williams, Chris McGath, Ashok Mishra, and Roger Strickland. Nov. 2005. "Agricultural Income and Finance Outlook." Economic Research Service, USDA. AIS-83

6"These expenses include the cost of all gasoline, diesel, natural gas, LP gas, motor oil, and grease products for the farm during 2002. It excludes fuel for personal use of automobiles by the family and others, fuel used for cooking and heating the farm house, and any other use outside of farmwork on the operation." Page A-24 Appendix A, 2002 Census of Agriculture, USDA, National Agricultural Statistics Service.

7Covey, et al., op cit.

8Shoemaker, Robbin, David McGranahan, William McBride. April, 2006. "Agriculture and Rural Communities Are Resilient to High Energy Use." Amber Waves, Vol. 4, Issue 2.

Who Will Get The Subsidy Bonus

The 2002 Farm Bill authorized "fixed direct payments" to commodity subsidy recipients as a partial replacement for the "agricultural marketing transition assistance" (AMTA) contract payments that subsidized farmers received under the 1996 "Freedom to Farm" law. As with the "Freedom to Farm" payments, taxpayers are obligated to make fixed direct payments automatically each year, even when farm prices and incomes are high, without regard to other subsidies the beneficiary may receive, and whether the recipient is an active farmer or an absentee landowner. Citing high energy costs in 2005, the Senate Appropriations Committee's $3.9 billion package of disaster assistance to agriculture includes a 30 percent increase in all "fixed direct payments" made in the 2005. This bonus subsidy will add $1.56 billion to the $5.2 billion in fixed direct payments already made to 1,120,525 recipients in 2005.

Congress has acted before to preferentially boost subsidies to a select group of subsidized farmers by increasing payments that were meant to be "fixed." In fiscal years 1999-2001, Congress provided $21.4 billion in "market loss payments" to farmers by essentially doubling the "Freedom to Farm" payments that had been "fixed", and originally set on a declining schedule, in the 1996 Farm Bill.

EWG obtained the fixed direct payments made in "program year" 2005 through a Freedom of Information Act request to USDA. We multiplied those fixed direct payments by 30 percent to estimate the bonus subsidy in the Senate bill. Our analysis of the payments shows:

- A total of 1,120,525 recipients will be eligible for the bonus subsidy, which will cost $1.56 billion.

- Just ten percentof the bonus subsidy recipients will collect nearly 60 percent of the money, or about $8,277 each. Bonus subsidies would be concentrated to an even greater degree among very large commercial farms were it not not for the payment limitation that governs fixed direct payments.

- The top 1 percent of bonus subsidy recipients will collect 15 percent of the payments, totaling $238 million, or over $21,000 each on average. Again, without the payment limit on fixed direct payments, the bonus subsidy would be even more concentrated.

- Some 54 large crop operations (including 1 State Agency and six Indian Tribes) will receive more than $100,000, and 476 recipients will collect over $50,000.

- The bottom 80 percent of recipients (896,420 of them) will receive a total of $330 million, or about $369 each on average.

- USDA records indicate that at least 10 percent of the bonus subsidy will go to recipients who own land but do not farm it themselves. These landowners, including absentee owners, have not incurred increased energy costs-the farm operators who rent their land have.

- The top five states for the bonus subsidy are Iowa, Illinois, Texas, Nebraska and Kansas, which together will receive 40 percent of the money. California, the number one state one farm state in terms of production value, will rank 12th in bonus subsidy payments, and Florida, ranked ninth for value of farm production, will rank 36th in bonus subsidy payments.

- Corn producers will account for the biggest share of bonus subidies, with $626 million (795,673 recipients). Wheat will follow, with $338 million (673,463 recipients), and upland cotton will account for $181 million (123,690 recipients).

- A minimum of $139 million in this bonus subsidy — 9 percent of the total — will be paid to landowners who do not farm the land, and thus did not incur the increased energy costs in 2005. Farm owners, as distinct from farmers who rent and operate their land, will likely collect a much larger share of the bonus subsidy as a result of USDA's expansive definition of "owner-operator" and "operator."

- Millions of dollars will be paid to absentee owners who live in or near major cities.

Questions of fairness and equity. The subsidy bonus for "high energy costs" that is contained in the Senate Appropriations Committee's emergency supplemental spending bill raises important questions of fairness.

First, to the extent that the subsidy bonus is rationalized as "relief" to farmers for high energy prices, it is manifestly unfair to hundreds of thousands of American farmers who also have experienced steep increases in energy costs during the past year, but who will be ineligible for the subsidy bonus for the simple reason that they have never received the "fixed direct payment" to which the bonus is pegged. The vast majority of America's farmers raise their crops and livestock for the marketplace, not the government. Once again, Washington will reward their independence by writing yet another check--for $1.5 billion--to the subsidy-dependent. What's more, a substantial share of the bonus subsidy will go not to the farm operators who actually incurred the higher energy costs last year, but to the farm owners from whom active farmers rent land.

Second, is it fair to single out for a bonus subsidy the same farmers who have been given near-record subsidies, projected at $23 billion in 2005, while other American workers and small businesses will have to absorb high energy costs that they, like farmers, cannot pass through to customers or recoup through increased wages and salaries that they do not control? In particular, is it fair for Congress to provide this $1.5 billion bonus subsidy to defray high energy costs just months after Congress stripped from the defense appropriations bill $2 billion in funding that was provided for the Low-Income Home Energy Assistance Program in the defense appropriations bill?9

Third, is it fair for the farm lobby to claim that the 2002 Farm Bill is a sacred 6-year contract with the public that must not be broken when it comes to prospective benefit cuts, but which readily can be breached in order to increase the "fixed direct payment" to subsidized crop farmers by 30 percent? The farm lobby and many in Congress invoked the "farm bill contract" argument to defend the status quo during the budget reconciliation process in 2005. Farm subsidy programs emerged unscathed, and a proposal to limit payments to large commercial farms was rebuffed, while significant budget cuts were imposed on health care for low-income children, rural development, agricultural research, highly popular farm conservation programs, and many other federal programs.

Finally, is it fair to provide 60 percent of the direct payment bonus-an estimated $936 million-to just 10 percent of the recipients? Should this bonus subsidy be capped, if it is provided at all, to save taxpayers money? Should it be modified to allow for assistance to a broader range of farmers, ranchers, or perhaps needy rural residents who frequently face higher than average transportation costs?

Conclusion: EWG Supports Emergency Disaster Aid, Opposes Bonus Subsidy

EWG supports the provisions in the pending Senate supplemental appropriations that provide disaster aid to farmers, ranchers, and other prospective beneficiaries who will be required to demonstrate that they actually suffered hurricane or other weather-related losses to crops, livestock, trees, or farmland in 2005. The only concern with this aid is a concern EWG has raised before: namely, that a substantial share of the funds will once again go to "disaster-prone"crop growing operations and regions that have habitually received aid through ad hoc disaster legislation year after year for the past decade or longer.10

However, EWG opposes the Senate provision to provide a $1.5 billion "economic loss" payment to commodity crop producers that is characterized by its sponsors as aid to defray higher farm costs in 2005 for fuel, electricity, natural gas, fertilizer and other energy-related expenses. By its very design, this measure is an unfair and ineffective response to rising energy prices in agriculture.

Footnotes

9According to the Center on Budget and Policy Priorities: "The defense appropriations bill contained two provisions related to LIHEAP funding. One would have provided $2 billion in additional funding for LIHEAP this winter. The second provision would, starting in 2008, have dedicated to LIHEAP a small percentage of federal receipts from the Arctic drilling. The second LIHEAP provision was tied to the oil drilling. The first provision was not. The Congressional Leadership elected to strip out both of the LIHEAP provisions when the ANWR provision was removed from the bill, a step that was unnecessary with regard to the $2 billion in funding for this winter." See Greenstein, Robert. December 23, 2005. "Congressional Leaders Misrepresent Why Energy Assistance Funds Were Stripped in Senate." Center on Budget and Policy Priorities. http://www.cbpp.org/12-23-05bud.htma>

10EWG has recommended a comprehensive review of the underlying economic and agronomic conditions that perpetually give rise to disaster assistance in these disaster-prone regions, and an assessment of policy options that could help farmers and ranchers make the transition to more sustainable agricultural production.

May 12, 2006 Analysis

Just 20 Congressional Districts Will Get Half of Controversial "Energy Assistance" To Agriculture

Vast Majority of U.S. Farmers and Ranchers Are Left Out--Again

WASHINGTON, May 12--It is billed by proponents in Congress as $1.5 billion in emergency aid to help U.S. agriculture weather skyrocketing energy prices.

But the majority of America's farmers, ranchers and rural residents will be excluded from the new subsidy, as the aid is funneled yet again to recipients of annual crop subsidies, who already collected a record $23 billion in 2005.

Over half of the proposed $1.5 billion bonus subsidy would be paid out to recipients in just 20 of the nation's 435 congressional districts, according to a new analysis by the Environmental Working Group (EWG). All of the top districts are located in regions that grow rice, cotton, corn and wheat and have been dependent on the government's farm subsidies for generations.

Dozens of heavily agricultural congressional districts in California, Florida, and other states would receive virtually nothing. Farms and ranches in those districts have felt the same squeeze of high energy prices, but will be excluded because they produce traditionally unsubsidized crops like fruits and vegetables, or raise livestock or poultry in response to market signals, not government payments.

The contrast is evident in the leadership of the House Agriculture Committee. Top committee Democrat Collin Peterson's district (MN-7){C} will rank eighth for the bonus subsidy, and stands to receive $40,521,149. {C} Republican Committee Chairman Bob Goodlatte's (VA-6)district will rank 194 for bonus subsidy payments, collecting just over $340,000.

Even within the top 20 districts for the proposed bonus subsidy a substantial number of farms and ranches will not qualify because they have not been subsidy recipients in the past. An average of 38 percent of the farms and ranches would be left out, ranging from 22 percent in Rep. Earl Pomeroy's (D) At-Large District of North Dakota, to over 82 percent in Republican Wally Herger's CA-2.

A third of the farms in Rep. Peterson's district, and over 80 percent in Rep. Goodlatte's district, will be automatically excluded from the subsidy not because energy prices have not affected them, but because they have not collected crop subsidies before.

USDA has said that 60 percent of U.S. farms and ranches would be excluded from the subsidy bonus.

"Every farmer and rancher in the country has taken a hit from high energy prices, but the vast majority of America's farmers raise their crops and livestock for the market, not the government," said Ken Cook, president of EWG. "Once again, Washington will reward their independence by writing yet another check--for $1.5 billion in 'energy assistance'--to the subsidy-dependent," Cook added. "Even worse, a substantial share of the bonus subsidy will go not to the farm operators who actually incurred the higher energy costs last year, but to those who own land registered for USDA subsidies and rent it out to working farmers." EWG estimates that at least 9 percent of the money will go to non-farming land owners, many of them absentee.

Like other crops subsidies, the bonus will be concentratedin the hands of large operations. Ten percent of the recipients would share 60 percent of the money, averaging over $8,200. The bottom 80 percent of those eligible would share 21 percent of the money, an average of $369.

Citing high energy costs in 2005, the Senate Appropriations Committee's $3.9 billion package of disaster assistance to agriculture includes a 30 percent increase in all "fixed direct payments" made to subsidized crop farmers in the 2005. This bonus subsidy will add $1.56 billion to the $5.2 billion in fixed direct payments already made to the same beneficiaries in 2005.

Federal data show that over 95 percent of America's farms and ranches - more than 2 million of them - reported expenditures for gasoline, fuels, and oil. In California in 2002, operators on 96 percent of the state's farms and ranches reported such expenditures, which amounted to $8,000 per farm on average. In Florida, 97 percent of agriculture operations reported those energy expenditures, which averaged about $3,400 per farm. In North Dakota, 84 percent of farms reported fuel expenditures at about $6,200 per farm.

The bonus was contained the Senate's version of an emergency spending bill to fund the Iraq war and Hurricane Katrina relief. The Senate added over $14 billion in spending, including $3.9 billion in disaster assistance for agriculture. President Bush has vowed to veto any measure that exceeds his $92 billion request for the Iraq war and Hurricane Katrina aid, the amount provided in the House of Representatives version of the law, plus additional funds to prepare for a potential outbreak of avian influenza. A House-Senate conference committee is working now to hash out the differences.