The cost to taxpayers of providing crop insurance to farmers has more than tripled since 2001, rising from an average of about $3 billion a year in 2001-2003 to more than $10 billion a year in 2012-2014. The increase is largely the result of sharp jumps in the cost of subsidizing both farmers’ premiums and the companies that sell crop insurance.

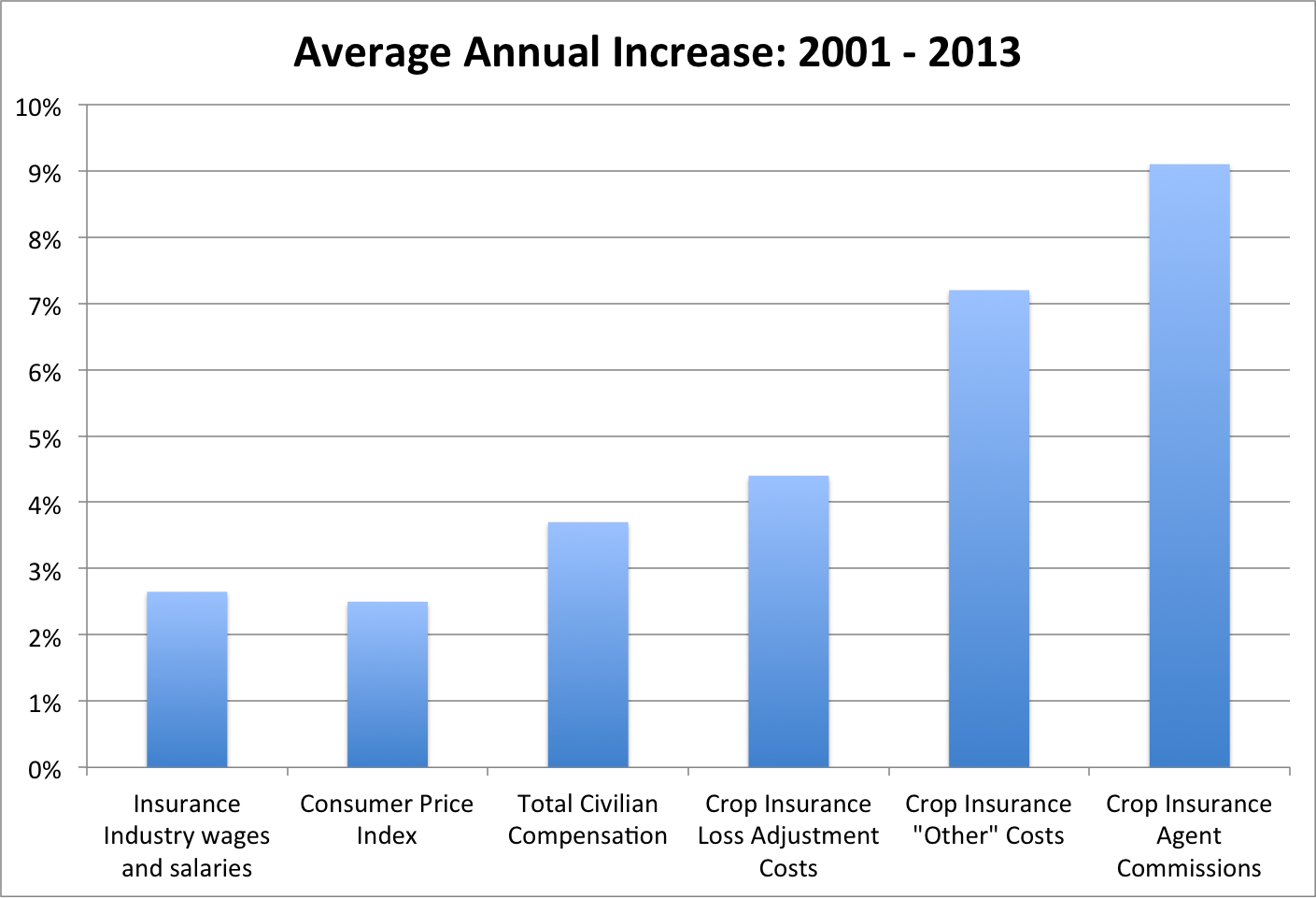

Notably, the commissions paid to crop insurance agents grew by an average of 9.1 percent per year between 2001 and 2013, more than three times the annual increase in the consumer price index and over twice the rate of increase in Americans’ total compensation over the same period.

The rapid escalation of costs has drawn well-deserved attention from policymakers looking to cut federal spending. The budget deal passed by Congress and signed by the President in early November would cut the cost of subsidizing the program by reducing the target rate of return enjoyed by crop insurance companies from 14 percent to 8.9 percent. This reduction would generate an estimated savings of $3 billion over 10 years.

Now, however, the industry and the agriculture committees in Congress are mounting an all-out effort to undo the cuts in the ongoing negotiations to prevent a threatened government shutdown on December 11.

Defenders of the status quo have railed against the cuts, arguing that their true purpose is not reform. Instead, they claim that they cuts are “… about killing the crop insurance program,”1 that they would “…gut the crop insurance program”2 and that they would be “…devastating cuts to crop insurance.”3

The reality, however, is that the cuts are a modest reduction in taxpayer support for crop insurance. The Congressional Budget Office pegs the average taxpayer cost of the program at $8.5 billion per year. The $300 million represents a reduction in subsidies of just 3.5 percent. The costs of using crop insurance companies to deliver the federal program include commissions to insurance agents, paying insurance adjusters to handle claims, salaries of company employees and basic office expenses.

The primary impact of cutting the rate of return to the companies would not be a reduction in profits but rather a reduction in industry costs. Rather than devastating or killing the program, the lower subsidies would result in a more efficient (but still far from lean) delivery system.

The total cost of delivering crop insurance – largely the wages, salaries and commissions paid to agents and employees – grew at an average rate of 8.2 percent a year between 2001 and 2013, driven largely by an average 9.1 percent annual increase in commissions paid to the insurance agents and a 7.2 percent increase in costs per policy not associated with loss adjustment. Over the same period, wages and salaries in the insurance industry as a whole grew by only 2.7 percent a year, the consumer price index rose by just 2.5 percent a year and total compensation to civilian employees by 3.7 percent a year. These costs grew while the number of policies sold stayed about the same. As a result the cost per policy grew from $628 in 2001 to $1,670 in 2013.

Crop insurance companies’ costs have inflated so dramatically because of the peculiar nature of competition in the industry. Companies can only sell insurance products that are approved by USDA’s Risk Management Agency at a government-regulated price. The companies don’t compete on price or on the products they offer and have limited ability to compete on quality of service, because most of the policies are sold and serviced by independent agents.

Instead, the companies compete for the agents’ customer base by offering higher commissions. When federal subsidies soared because of high commodity prices in the mid-2000s, competition for business dramatically increased agents’ commissions. The average commission per policy grew from $358 in 2001 to $1,022 per policy in 2013.

The industry has plenty of room to reduce costs while maintaining a more than healthy rate of return even if its revenue falls by $300 million a year. If the annual increase in crop insurance companies’ costs had been held to 3.7 percent – the rate of increase in total civilian compensation – those costs would have been reduced by $767 million in 2013.

Agents’ commissions would bear most of brunt of the proposed cost cutting because their commissions increased faster than the other components of the companies’ delivery costs. Farmers won’t see any increase in premiums because premiums are set by the government, not the companies.

The $300 million annual cut in subsidies will not cause compensation rates for agents and others in engaged in crop insurance to fall below industry standards. There is no reason to think there would be a large exodus of agents or companies from the crop insurance program. Instead of devastating the program, the subsidy cuts would make the program more efficient and less costly for taxpayers.

Introduction

The cost to taxpayers of providing crop insurance has more than tripled since 2001, increasing from an average of about $3 billion a year in 2001-2003 to more than $10 billion annually in 2012-2014. The Congressional Budget Office projects costs will average more than $8.5 billion a year in the future.The program’s costs have increased dramatically because both the cost of subsidizing farmers’ premiums and the cost of subsidizing the private-sector delivery of crop insurance have soared. Unlike typical insurance, where the premiums cover both the cost of paying claims and the cost of delivering the insurance, the premiums paid by farmers cover only about 40 percent of the cost of claims paid and none of the cost of delivering the policy: adjusting loss claims, agent commissions, salaries and other overhead, including profit.

Any rapid escalation in the cost of running a government program invites scrutiny for signs of waste and improvements in efficiency. The Obama Administration has long advocated modest cuts in the crop insurance subsidies to farmers and to insurance companies, believing that both are excessive. Many in Congress support such proposals for reform. But these supporters are not members of the House and Senate agriculture committees, where attempts to reduce subsidies have consistently been thwarted.

The recent budget agreement passed by Congress and signed by President Obama bypassed those committees, which explains how the modest cut in the subsidies was achieved. However, that victory for advocates of reform was short-lived. Defenders of the status quo for crop insurance have railed against the cuts, arguing that their true purpose is not about reform. Instead, they claim that the cuts are “… about killing the crop insurance program”4 that they would “…gut the crop insurance program”5 and that they represent “…devastating cuts to crop insurance.”6 The all-out effort against the reduction in subsidies has resulted in an agreement between Congressional leaders and the agriculture committees to replace the savings from crop insurance with other savings that will be identified later this year as part of budget negotiations.

What was agreed to in the budget deal was a reduction from 14 percent to 8.9 percent in the target rate of return for crop insurance companies. This reduction would generate estimated savings of $3 billion over 10 years, for an average of about $300 million a year, a modest drop in taxpayer support. The average annual taxpayer cost of the program is budgeted by the Congressional Budget Office at $8.5 billion per year, so the $300 million is a 3.5 percent reduction in subsidies. It seems implausible that such a modest drop in subsidies could lead to devastating impacts to the crop insurance program.

While the program’s defenders have been quick to argue against the cut in subsidies, reform supporters have been mostly silent.7 This asymmetry in information and passion is typical when subsidies are cut. Although all taxpayers reap the benefits of lower program costs, the benefit to each individual is so small that it is not worth the effort to fight for them. In contrast, the few who are directly affected by a cut in their subsidies have a large financial incentive to reverse them.

One of the most effective arguments against cutting subsidies is that they serve a broad public purpose. Advocates of crop insurance subsidies argue that they are needed to stabilize agriculture and ensure that food is readily available to the American public. While it is easy to debunk arguments that the subsidies serve the public’s interest, those claims deflect attention from the actual impact that a reduction in subsidies would have.

The objective of this analysis is to explain how the proposed reduction in subsidies would affect the crop insurance program. More balanced information about the impact of reduced subsidies should lead to a better- informed debate. Given the recent cuts to government programs that actually serve broad public interests – such as weather forecasting, law enforcement, tax collection, highway funding, pollution control, public health measures and food safety programs – it makes economic sense to cut programs that fund narrow interests in order to preserve programs that serve the public at large.

This analysis demonstrates that the primary impact of a cut in the rate of return to crop insurance companies would not be lost profits for the industry but rather a reduction in its costs. Rather than devastating or killing the program, the proposed reductions in subsidies would result in a more efficient (yet still far from lean) crop insurance delivery system.

Delivering Crop Insurance Through Companies is Costly

The recent budget agreement calls for a reduction in the target rate of return to crop insurance companies. Rate of return is defined by the industry as profit as a percentage of premium. Profit is defined as revenue received in excess of costs.

Data on costs up through the 2013 crop insurance year are available in a publication prepared by the accounting firm Grant Thornton LLP.8 Exhibit 5.1 of the report measures costs from 1992 to 2013 as a percentage of gross premium. Costs for adjusting claims, agent commissions and all other expenses are reported separately. The “other” category of expenses presumably includes salaries, IT expenses, and other office expenses. Total cost for each category can be obtained by multiplying the percentages by gross premium for each year, data that is available from USDA’s Risk Management Agency. Table 1 shows the results.

From 2001 to 2013, crop insurance companies’ total costs increased by 156 percent, or about 8.2 percent per year. This rate of increase is more than three times the average inflation rate of 2.5 percent a year over this time period.

Table 1. Company Costs of Delivering Crop Insurance

| Agent Commission | Loss Adjustment | Other | Total | |

|

|

||||

| 2001 | 465 | 110 | 240 | 815 |

| 2002 | 461 | 122 | 245 | 828 |

| 2003 | 546 | 113 | 237 | 895 |

| 2004 | 653 | 117 | 251 | 1,021 |

| 2005 | 600 | 130 | 261 | 991 |

| 2006 | 714 | 133 | 284 | 1,131 |

| 2007 | 1,116 | 151 | 302 | 1,568 |

| 2008 | 1,655 | 177 | 296 | 2,128 |

| 2009 | 1,504 | 224 | 367 | 2,094 |

| 2010 | 1,268 | 213 | 395 | 1,875 |

| 2011 | 1,281 | 263 | 407 | 1,951 |

| 2012 | 1,090 | 278 | 445 | 1,812 |

| 2013 | 1,251 | 319 | 519 | 2,089 |

One possible explanation for why costs increased faster than inflation is that the amount of work increased dramatically. One measure of workload is the number of policies issued, reflecting the amount of work involved in selling and administering them. The amount of work devoted to adjusting losses varies with the number of claims made. Thus a better measure of the workload is the number of farms that generate claims. Table 2 shows the total number of policies and the number of farms on which claims were made (units indemnified). Table 2 uses these measures of workload to calculate the costs per policy for agent commissions and other costs, as well as the costs per unit indemnified.

Table 2. Cost of Delivering Crop Insurance Adjusted for Workload

| Year | Units Indemnified | Number of Policies | Agent Commission | Loss Adjustment | Other |

|

|

$ per policy | $ per unit | $ per policy | ||

| 2001 | 674 | 1,298 | 358 | 163 | 185 |

| 2002 | 958 | 1,259 | 366 | 128 | 195 |

| 2003 | 778 | 1,241 | 440 | 146 | 191 |

| 2004 | 663 | 1,229 | 531 | 177 | 204 |

| 2005 | 523 | 1,191 | 504 | 249 | 219 |

| 2006 | 669 | 1,148 | 622 | 198 | 247 |

| 2007 | 567 | 1,138 | 980 | 266 | 265 |

| 2008 | 1,048 | 1,149 | 1441 | 169 | 257 |

| 2009 | 593 | 1,172 | 1283 | 377 | 313 |

| 2010 | 463 | 1,140 | 1112 | 459 | 346 |

| 2011 | 954 | 1,136 | 1127 | 276 | 358 |

| 2012 | 1,202 | 1,174 | 928 | 231 | 379 |

| 2013 | 1,166 | 1,224 | 1,022 | 273 | 424 |

The number of policies sold has been roughly stable over this time period. The number of farms indemnified varies dramatically from year to year because of variations in growing season weather.

Agent commissions per policy increased by an average annual rate of 9.1 percent, increasing from $358 per policy to more than $1,022.9 The costs of adjusting claims per unit indemnified increased by 4.4 percent per year. Other expenses increased by 7.2 percent per year. To put these cost increases into perspective, the US Bureau of Labor Statistics reports that total compensation to civilian workers increased by an average annual rate of 3.7 percent over this time period, which is somewhat higher than the 2.5 percent average increase in consumer prices. Wages and salaries in the insurance industry grew by an average of 2.65 percent per year from 2002 to 2013.

These data clearly show that costs in the crop insurance industry increased at a much faster rate than in other industries and much faster than in the rest of the insurance industry. The reason costs increased so much faster is the peculiar nature of the industry and its relationship with the federal government.

Rate of Return with Lower Cost Inflation

It is instructive to calculate what the costs of delivering crop insurance would have been in 2013 had they increased only as fast as total civilian compensation, and what impact this lower rate would have had on the rate of return in the industry from 2001 to 2013.

Suppose that work-adjusted costs in each of the three cost categories for crop insurance had increased by 3.7 percent per year from 2001 to 2013, which is how fast total civilian compensation rose. The 3.7 percent rate of increase is higher than the rate at which wages and salaries actually increased in the rest of the insurance industry.

Table 3 shows what work-adjusted costs for each category would have been at a 3.7 percent rate of increase, what total costs would have been, and what costs actually were. Total crop insurance delivery costs at this inflation rate would have been $1.32 billion in 2013 rather than $2.09 billion, a difference of $767 million. Costs would have been 37 percent lower in 2013 than they actually were if they had increased similarly to the rest of the economy.

Table 3. Crop Insurance Costs Assuming Lower Inflation

| Year | Agent Commission | Loss Adjustment | Other | Total | Difference from Actual |

|

|

|||||

| 2001 | 465 | 110 | 240 | 815 | 0 |

| 2002 | 468 | 162 | 241 | 871 | 42 |

| 2003 | 478 | 136 | 247 | 861 | -35 |

| 2004 | 491 | 120 | 253 | 865 | -157 |

| 2005 | 493 | 98 | 255 | 846 | -145 |

| 2006 | 493 | 130 | 254 | 878 | -253 |

| 2007 | 507 | 115 | 262 | 883 | -685 |

| 2008 | 531 | 220 | 274 | 1,024 | -1,104 |

| 2009 | 562 | 129 | 290 | 980 | -1,114 |

| 2010 | 566 | 104 | 292 | 963 | -912 |

| 2011 | 585 | 223 | 302 | 1,110 | -841 |

| 2012 | 627 | 291 | 324 | 1,242 | -570 |

| 2013 | 678 | 293 | 350 | 1,321 | -767 |

Table 4 shows what pre-tax profits and the rate of return to the crop insurance industry would have been over the same period had cost inflation been held to 3.7 percent per year. The average rate of return from 2001 to 2013 calculated by the accounting firm Grant Thornton LLP was 11.3 percent. If costs had risen at 3.7 percent per year the average rate of return would have been 19.0 percent.

The results in Tables 3 and 4 present an economic puzzle. It seems odd that crop insurance costs could increase so rapidly compared to the rest of the economy and the rest of the insurance industry. One would expect that new companies with lower cost structures would enter the market and out-compete the high-cost companies.

Table 4 shows that a low-cost competitor would have been able to earn a much higher rate of return than the industry average. Once more efficient companies enter a business, competition should lower the rates of return to competitive levels. Existing high-cost companies have to cut costs or they go out of business. The fact that costs rose much faster in crop insurance than the industry average is evidence that normal competitive forces are not at work. Understanding why competition has not led to cost control explains why the budget agreement’s reduction in subsidies to crop insurance companies will not affect either their ability or willingness to deliver crop insurance to farmers.

Table 4. Impact on Rate of Return of Lower Cost Inflation

| Year | Net Incomea | Alternative Net Incomeb | Retained Premiuma | Actual Rate of Returna | Alternative Rate of Returnc |

|

|

|||||

| 2001 | 166 | 166 | 2,372 | 7% | 7% |

| 2002 | -248 | -290 | 2,295 | -11% | -13% |

| 2003 | 214 | 248 | 2,607 | 8% | 10% |

| 2004 | 558 | 715 | 3,145 | 18% | 23% |

| 2005 | 756 | 900 | 2,893 | 26% | 31% |

| 2006 | 641 | 894 | 3,502 | 18% | 26% |

| 2007 | 1,364 | 2,049 | 4,899 | 28% | 42% |

| 2008 | 944 | 2,048 | 7,744 | 12% | 26% |

| 2009 | 1,750 | 2,864 | 6,627 | 26% | 43% |

| 2010 | 1,389 | 2,301 | 6,053 | 23% | 38% |

| 2011 | 1,131 | 1,972 | 9,531 | 12% | 21% |

| 2012 | -1,747 | -1,177 | 8,640 | -20% | -14% |

| 2013 | -62 | 705 | 9,230 | -1% | 8% |

a From Exhibit 1, Grant Thornton LLP.

b Net Income minus last column from Table 3.

c Alternative Net Income divided by Retained Premium

Competition in the Crop Insurance Industry

In most of the insurance industry, companies compete on the prices they charge for their products, on their product offerings and on their quality of service. Competition prevents profits from getting too high or too low. If profits are too low, premiums tend to rise. If they didn’t, companies would either go out of business or fail to meet the financial reserve requirements set by regulators. If profits are high, premiums tend to fall as companies compete to expand their customer base and new competitors enter the industry.

However, crop insurance companies are not like other insurance companies, because they do not compete on price or on the products they offer, and they have limited ability to compete on quality of service. The large subsidies that the federal crop insurance program provides make it impossible for purely private insurance products to compete. Farmers would have to pay more than double what they currently pay for similar insurance offered by the private sector. Instead, all crop insurance companies sell the same products at the same government-regulated price. 10 Most policies are sold through independent agents, who are by far the most important point of contact farmers have with the crop insurance program. Because the companies are a step removed from their customers, the opportunities to offer improved service are quite limited. In fact, many farmers do not even know which company insures their crop.

But competition does exist in crop insurance. Companies compete for the agents’ business and for specialists such as claims adjusters, insurance underwriters and knowledgeable executives. Agents can deliver their customers to any crop insurance company that does business in the state. And being rational, agents tend to deliver their business to the company that offers them the highest commissions.11

To see how this competition worked before a cap on agent commissions was imposed on July 2010, suppose that an agent in Iowa books of business with $1 million in premiums. The crop insurance companies know how much net revenue to expect from this amount of business. The revenue is generated from the government’s Administrative and Operating (A&O) reimbursements and by the net underwriting gain. The net underwriting gain is the amount by which the $1 million in premium is expected to exceed the claims paid out after accounting for all government-provided reinsurance program details.

Comparing underwriting gains in Iowa with Texas explains why agent commissions in Iowa are higher. Traditionally, Iowa business has generated large net underwriting gains. With an A&O reimbursement rate of 20 percent and net underwriting gains of 15 percent, the $1 million in premiums will generate $300,000 in expected revenue for a crop insurance company. How much will a crop insurance company be willing to pay the agent for this business? The maximum amount that a company will pay will be less than $300,000 because there are extra costs associated with servicing the extra business, the most prominent being loss adjustment costs. All other costs are largely fixed. If expected loss adjustment costs are $30,000, then a company will be willing to pay the agent up to $270,000 for this business. That means the agent’s commission would be 27 percent of premium.

Since the commissions paid to agents represents a real cost to the crop insurance companies, they will try to pay less than $270,000. But, if there is sufficient competition between companies and the agent is a skillful negotiator, the commission in this example should be close to 27 percent.

Now suppose that an agent in Texas also has a $1 million book of business. The expected underwriting gain in Texas is much lower than in Iowa because growing conditions are much more variable in Texas and insurance premiums have not increased enough to reflect this higher variability. To keep it simple, suppose that the expected underwriting gains in Texas are zero and that loss adjustment costs are $60,000, because losses are much more frequent in Texas. Simple arithmetic shows that the maximum amount a company will be willing to pay for the Texas business is $140,000, which represents a commission rate of 14 percent. Because crop insurance in Texas is less profitable than in Iowa, fewer crop insurance companies operate in Texas and there is less competition for an agent’s business. As a result, the Texas agent’s actual commission rate may not approach the theoretical maximum of 14 percent.

Smith, Glauber, and Dismukes12 provide empirical support for a positive relationship between agent commissions and the amount of revenue generated from A&O and underwriting gains. An important implication of this relationship is that when expected revenue from a book of business changes, then so too will agent commissions. What this means is that competition between crop insurance companies will reveal itself on the cost side of the profit equation, rather than on the revenue side, which is fixed by government regulation. That is, if the rate of return by crop insurance companies is too high, competition will raise costs, thereby driving down rates of return to competitive levels. If rates of return are too low, competition will lower costs until rates of return are high enough to keep companies in the business.

This competition for agent business drove commissions so high that USDA’s Risk Management Agency capped commission rates beginning with the 2011 crop year. Agents who had been receiving commission rates above the newly capped levels saw their commissions drop. The new limit on the amount of money that could go to agents meant increased opportunities for excess revenue to flow to other cost categories, which explains why other costs in Table 1 increased by $124 million (31 percent) after commissions were capped. Although commission rates are capped, they are still much higher than they would be if the crop insurance industry faced normal economic competition.

Reducing the Rate of Return will Reduce Costs

The recent budget agreement calls for a decrease in the target rate of return for crop insurance companies from 14 percent to 8.9 percent. The target rate of return is set in the Standard Reinsurance Agreement (SRA) between the government and companies interested in selling and servicing insurance policies under the program. The SRA establishes a target rate of return the companies would expect to enjoy by determining net underwriting gains and A&O reimbursements. Presumably, the decrease in the target rate of return would be implemented by a cut in the subsidies to companies, which would entail a reduction in underwriting gains and/or in A&O.

The industry and its Congressional patrons are ringing alarm bells about the budget agreement, claiming that crop insurance companies will no longer participate in the federal program, the program will fail and farmers won’t be able to secure insurance.

The facts tell a very different story. Crop insurance companies have more than enough room to cut costs to maintain a healthy rate of return. Companies won’t exit the program. Instead, they will reduce commissions paid to agents and control other costs to boost their rate of return.

In 2014, the industry retained about $8 billion in premiums. The current 14 percent target rate of return on $8 billion of retained premium implies a profit of $1.12 billion a year. The 8.9 percent rate of return on the same $8 billion in retained premium implies a profit of $712 million, which is a drop of about $400 million. The new SRA mandated by the budget agreement must cut revenue to crop insurance companies by $400 million per year to achieve that 8.9 percent rate of return.

Crop insurance costs, however, will decline accordingly because costs reflect the level of government subsidies that flow to the industry. Agent commissions and other costs, which include industry salaries, have increased much faster than they would have if crop insurance were subject to the same market forces as the rest of the industry. Costs are $767 million higher than they would be if crop insurance companies faced the kind of competition that the rest of the industry does (Table 3). In response to a $400 million drop in subsidies, companies would shed enough costs to make the rate of return high enough to ensure that they continue to operate.

Agent commissions would bear most of the brunt of this cost decrease because commissions increased faster than other costs. In 2013 agent commissions were $1.25 billion – 60 percent of total costs. If agent commissions had increased at 3.7 percent per year rather than 9.1 percent per year, they would have totaled $678 million (Table 3). If agent commissions alone absorbed the full $400 million cut in subsidies, they would still be higher than they would be if they had increased at the same rate as civilian compensation between 2001 and 2013.

However, agent commissions would not have to bear the full brunt of the cost reduction. Other company costs have increased at 7.2 percent per year in response to growing government subsidies. The additional revenue has apparently made its way into higher than required salaries and benefits for company personnel. Some proportion of the cost reduction would likely be achieved by getting salaries and benefits more in line with the insurance industry as a whole.

Policy Implications

The costs of delivering crop insurance have increased far faster than they would have if the companies had been subject to the same market forces as the rest of the insurance industry. Inability to compete on price meant that the dramatic increase in subsidies flowing to companies beginning in 2006 was reflected in a surge in costs, most notably by a dramatic increase in agent commissions. Because costs are still much higher than they would be if the crop insurance industry faced normal competitive pressures, the first response to a reduction in revenue from the program would be a reduction in the companies’ cost structure. Put in simple terms, a reduction in taxpayer support as called for in the budget agreement would remove some of the excessive industry costs.

Opponents of reductions in subsidies either do not understand that costs would adjust, or else they do understand and are being disingenuous about the effects in order to protect agent commissions and companies’ salary levels. Because company costs would adjust to a reduction in subsidies, farmers would be unaffected by the budget agreement as long as the reduction is not so severe that people would not want to continue as to work as agents or loss adjusters. The data suggest that the budget agreement’s required reductions are not large enough to cause compensation rates for agents and others in the industry to fall below industry standards. There is no reason to think that there would be a large exodus of agents or others from the industry.

Congress and the Administration will have trouble achieving a lower target rate of return by renegotiating the Standard Reinsurance Agreement. After costs adjust to reflect the cut in subsidies, the rate of return would rebound to the level needed to keep companies engaged in the program. Forcing companies to bid against each other for approval to sell federally subsidized crop insurance would be a more effective way to cut costs and reduce the rate of return to insurance companies.